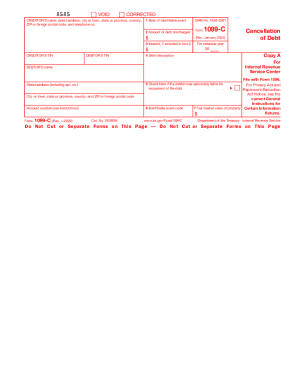

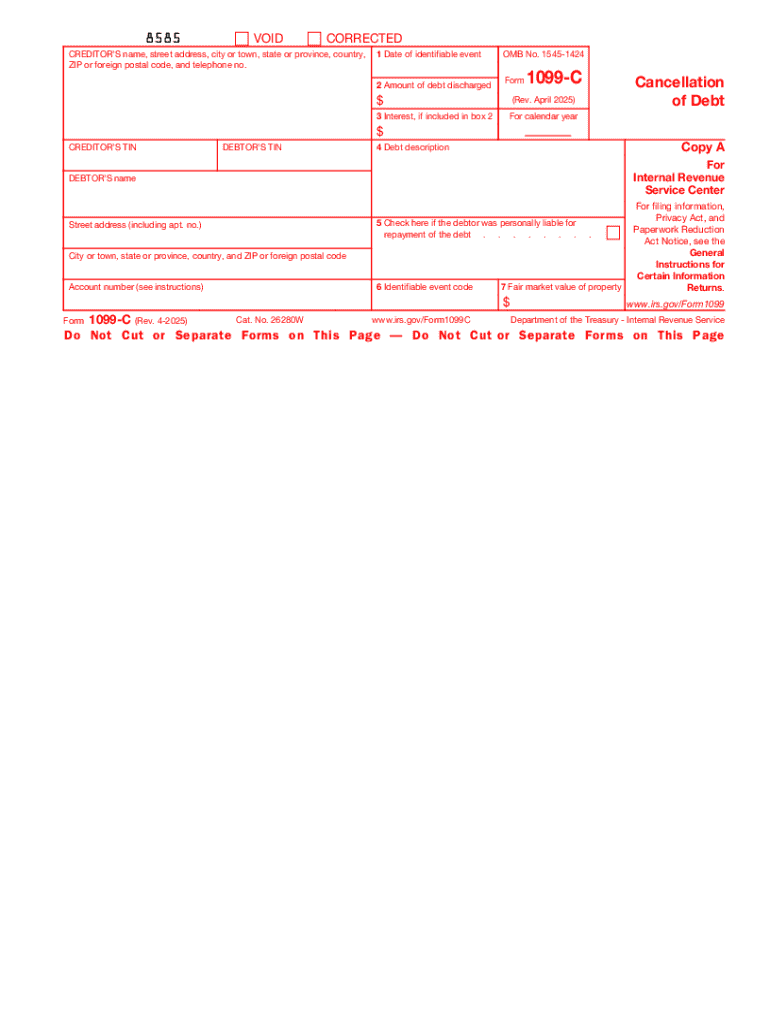

IRS 1099-C 2025-2026 free printable template

Instructions and Help about IRS 1099-C

How to edit IRS 1099-C

How to fill out IRS 1099-C

Latest updates to IRS 1099-C

All You Need to Know About IRS 1099-C

What is IRS 1099-C?

When am I exempt from filling out this form?

Due date

What are the penalties for not issuing the form?

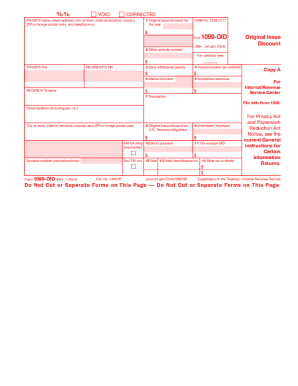

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

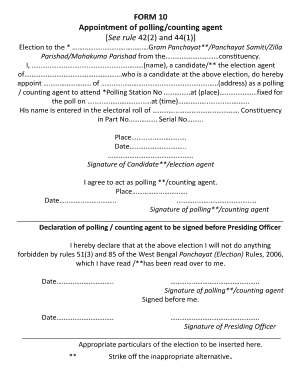

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1099-C

What should I do if I discover an error after submitting my IRS 1099-C?

If you find a mistake on your IRS 1099-C, you should file a corrected form as soon as possible. Indicate that it is a correction and provide the accurate information to ensure proper reporting. It's also advisable to keep records of both the original and corrected forms for your documentation.

How can I verify if my IRS 1099-C has been received and processed?

You can verify the status of your IRS 1099-C by checking with the IRS e-file system or contacting their support. Keep in mind common e-file rejection codes, which can help you troubleshoot if your submission hasn't gone through. Maintaining a copy of your submission can aid in these inquiries.

What are the privacy considerations when filing the IRS 1099-C?

When filing the IRS 1099-C, ensure that you're protecting the sensitive information of the payee involved. Use encrypted channels if filing electronically and keep all files secure to safeguard against data breaches. Also, adhere to the record retention period outlined by the IRS for potential audits.

Can I file the IRS 1099-C on behalf of someone else?

Yes, you can file the IRS 1099-C on behalf of another person if you have the appropriate authorization, such as a power of attorney (POA). Ensure you’re aware of any additional requirements or responsibilities when filing for someone else, especially in cases involving nonresidents or foreign payees.

What common errors should I avoid when submitting my IRS 1099-C?

Common errors when submitting your IRS 1099-C include incorrect taxpayer identification numbers and improper reporting of debt cancellation amounts. Double-checking these details before submission can help you avoid rejections or corrections later on. It's also wise to consult with a tax professional if you're unsure about specific situations.

See what our users say